Caring for someone with dementia is not just an emotional journey - it’s a financial one too. As memory fades and daily tasks become harder to manage, expenses increase, decisions grow more complex, and planning becomes crucial.

From medical bills to long-term care costs and legal paperwork, many caregivers find themselves in unfamiliar territory. And while no one can predict every twist in the road, early and proactive financial planning can reduce stress, avoid crisis decisions, and help everyone involved feel more secure.

Whether you're just starting the caregiving journey or have been in it for a while, here are practical, expert-backed financial tips for navigating dementia care with clarity and confidence.

1. Start Planning Early

The sooner you begin financial and legal planning, the more choices you’ll have. Ideally, discussions should happen while the person living with dementia is still able to participate in decisions and express their wishes.

According to the Alzheimer’s Association, this includes reviewing:

- Monthly expenses and income

- Insurance coverage

- Long-term care options

- Legal documents like powers of attorney and advance directives

👉 See Alzheimer’s Association planning resources

2. Have the Money Talk - Openly

Finances can be a sensitive subject, especially between parents and adult children or spouses. But open communication is essential. Approach it with empathy:

“I want to make sure we’re prepared for the future and honoring your preferences. Can we talk through some plans together?”

Make a list of current financial obligations and ask questions about account access, debts, or insurance policies. The National Institute on Aging recommends organizing everything into one place and reviewing it regularly.

👉 Explore NIA’s money management tips

3. Get Legal Authority in Place

As dementia progresses, managing finances becomes more challenging - and potentially risky. It’s important to legally authorize someone to make financial decisions through a Power of Attorney (POA). You may also consider:

- Durable Power of Attorney (for ongoing financial decisions)

- Living Will and Health Care Proxy (for medical decisions)

- Guardianship (if POA is not in place and mental capacity is lost)

These documents ensure bills can be paid, assets protected, and care decisions made without unnecessary delays or court involvement.

4. Monitor and Manage Spending

People with dementia are more vulnerable to financial exploitation, scams, or simply forgetting how to manage money. Set up tools and safeguards to help:

- Automate bill payments

- Use alerts for large transactions

- Limit credit card access

- Set up shared bank accounts (with clear legal authority)

The Alzheimer’s.gov guide recommends gently transitioning financial responsibilities over time to reduce stress and confusion.

👉 Read Alzheimer’s.gov tips for caregivers

5. Understand Long-Term Care Costs

Long-term care is one of the biggest financial challenges in dementia. It may include:

- In-home care

- Adult day programs

- Memory care or assisted living

- Residential care homes

- Hospice or palliative services

These costs vary widely depending on location, level of care, and insurance. Get familiar with your options early. Reach out to a certified financial planner or elder law attorney who specializes in dementia and aged care planning.

6. Explore Financial Assistance Options

Caregiving doesn’t have to fall solely on your shoulders - or your wallet. You may be eligible for support through:

- Veterans’ benefits

- Medicaid or long-term care insurance

- Carer support subsidies (depending on your country or region)

- Local nonprofit organizations and dementia care funds

👉 AARP’s 9 financial planning tips for dementia care

Don’t be afraid to ask a social worker, community nurse, or dementia organization for help navigating available resources.

7. Track Your Caregiving Expenses

Many caregivers spend out of pocket but don’t track where the money goes. Start recording expenses such as:

- Transportation

- Home modifications

- Medication or equipment

- Time off work

This can help you make informed decisions, apply for support, or even advocate for tax deductions depending on your situation.

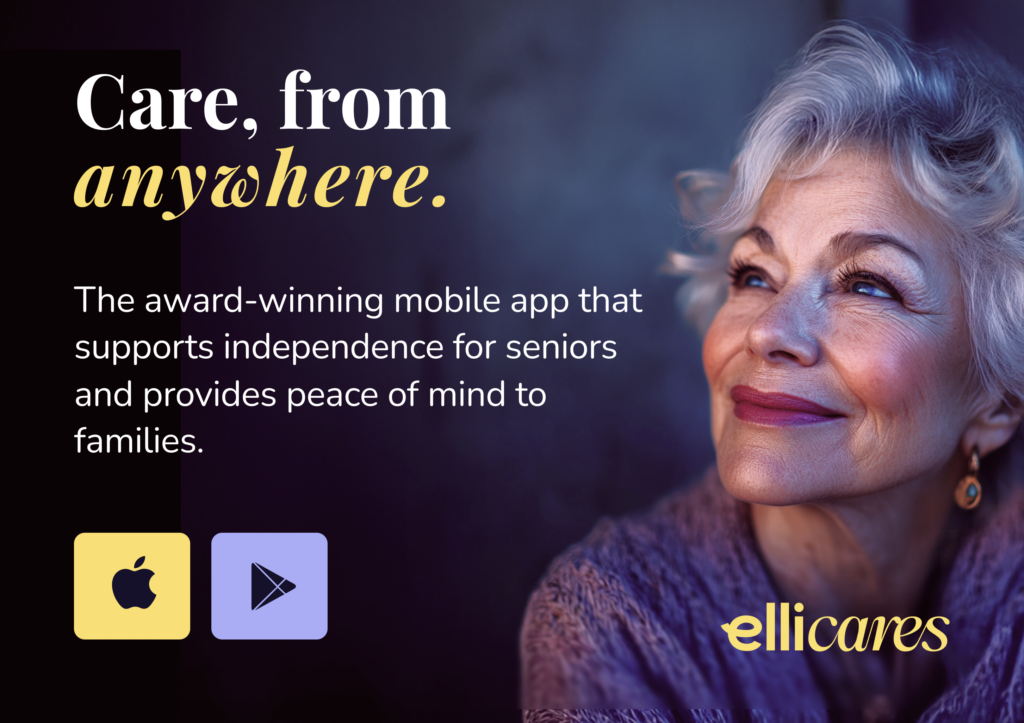

How Elli Cares Can Help

The Elli Cares app supports families by offering structure, visibility, and peace of mind. While not a financial tool, it reduces emotional and logistical stress through:

- Reminders for medication and appointments

- Safe Zones and location tracking

- Mood and symptom logs

- Care team coordination

These features can help reduce the need for emergency expenses and keep loved ones independent longer.

👉 Learn more at www.elliapp.co