Dementia is one of the most pressing public health challenges of our time. As populations age, families and healthcare systems alike face mounting pressure to provide compassionate, cost-effective care for people living with cognitive impairment.

Technology has emerged as a powerful ally. From apps that send medication reminders to those that enable real-time family oversight and location tracking, digital tools are transforming dementia care. And yet, most of these technologies - no matter how helpful - aren’t covered by insurance.

That needs to change.

Why Insurance Should Cover Dementia Support Apps

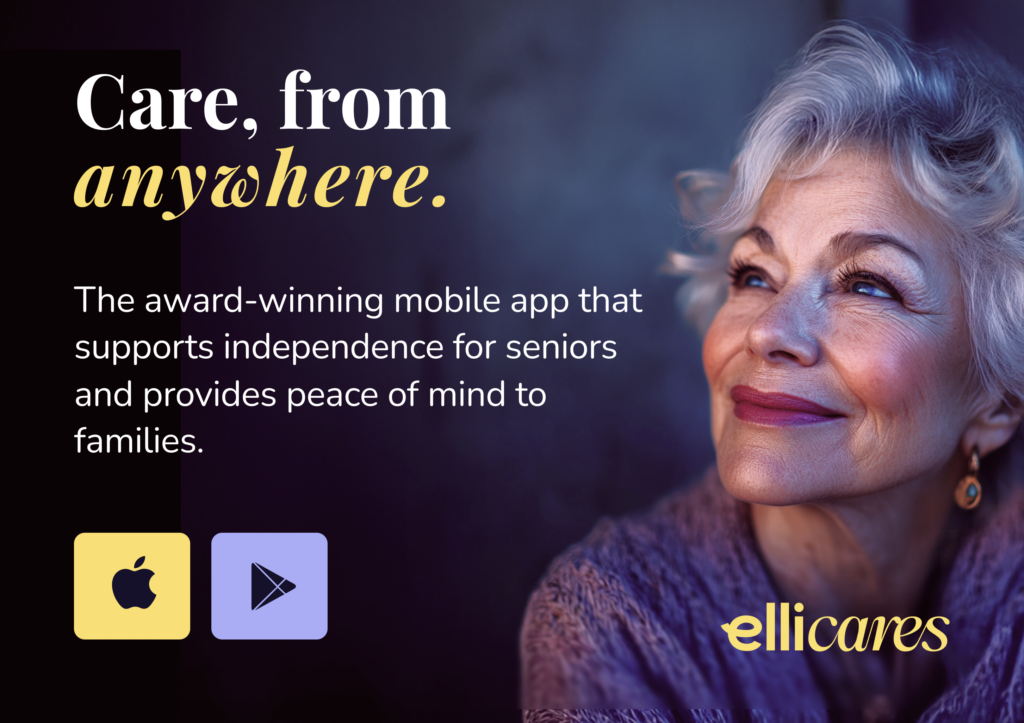

Apps like Elli Cares are designed to support aging in place, extend independence, and reduce caregiver burden. They provide critical services that mimic and sometimes replace the need for human intervention, but at a fraction of the cost. If a mobility aid or blood glucose monitor is reimbursed by insurance, why not digital tools that promote cognitive safety and well-being?

Here’s the case for including dementia support apps in insurance plans.

1. They Lower the Cost of Care

The average cost of caring for someone with dementia exceeds $50,000 per year in many developed countries. According to the Alzheimer’s Association, unpaid caregivers in the U.S. alone provide billions of hours of care annually, resulting in enormous indirect costs.

Apps like Elli Cares reduce the need for constant supervision by offering features like:

- Video and voice reminders for medications, hydration, and daily tasks

- Safe Zones with GPS-based alerts

- Activity monitoring through Safe Track for unusual behavioral changes

These features help prevent accidents, missed medications, and caregiver burnout—events that often lead to costly ER visits or residential care.

🔗 Also read: NIH: The Economic Impact of Alzheimer’s Disease

2. They Extend Independent Living

Aging in place isn’t just a preference - it’s often safer, more familiar, and less expensive than residential facilities. But for families, the challenge is ensuring safety without overstepping.

Elli Cares bridges this gap. With customizable reminders, family check-ins, and features that offer gentle oversight rather than control, the app supports older adults to stay in their own homes longer.

When older adults feel more confident managing daily life, there’s less risk of early transition into high-cost care settings. Insurance coverage of supportive tech can make this sustainable and equitable for more families.

👉 Read about: How to Support Aging Parents Without Taking Over

3. They Reduce Caregiver Burnout

Burnout is one of the leading reasons caregivers reduce work hours, leave jobs, or experience mental health issues. The ability to automate care reminders or check a loved one’s well-being remotely through an app significantly lightens the emotional load.

Health insurers already cover caregiver education and some respite services. Including dementia support apps in coverage models could:

- Empower caregivers to step back, while staying informed

- Reduce depression and anxiety

- Improve care quality without increasing caregiver time

👉 Check out the Caregiver Action Network's Caregiver Toolbox for excellent resources

4. They Offer Scalable, Personalized Support

Unlike institutional care, digital solutions scale with ease. One caregiver can use an app like Elli Cares to stay in touch with multiple family members’ care needs from anywhere.

The app also supports personalization - adjusting reminders, tones, and timing based on the user’s routine and preferences. This kind of tailored care is rarely feasible in traditional care settings without significant cost.

👉 Related article: The Best Daily Routines for Seniors With Early Dementia

5. They Promote Early Detection and Intervention

Features like Elli Cares’ Safe Track can flag changes in behavior or device usage - often subtle signs of cognitive or physical decline. These early warnings allow families to intervene sooner and consult healthcare providers before a crisis emerges.

Early intervention is one of the best ways to reduce long-term care costs and improve outcomes. Insurance models focused on preventative care should consider apps like this essential tools in the care continuum.

The Policy Opportunity

Insurers, especially those in value-based care or with aging customer bases, have a unique opportunity to lead. Covering dementia support apps could:

- Decrease reliance on high-cost interventions

- Improve satisfaction among policyholders and their families

- Support broader public health outcomes, including aging in place

This is particularly relevant in countries like New Zealand and Australia, where aging-in-place strategies are government priorities. Encouraging insurers and aged care providers to pilot app-based interventions - like Elli Cares - is a logical next step.

Digital dementia support is not a luxury - it’s a necessity. It represents a critical shift from reactive to proactive care. With the right policies in place, insurance providers can champion this transformation by reimbursing supportive tech like Elli Cares.

In doing so, they’ll empower families, reduce systemic costs, and help older adults retain autonomy in the face of a challenging diagnosis.

The future of dementia care isn’t just human. It’s human plus smart, compassionate technology. It’s time insurance caught up.